- Home

- Infographic

- News

- Impacts of the RBA rate cut

Impacts of the RBA rate cut

The RBA cut the cash rate to a new record low of 1.75 per cent today on the back of last week's shock inflation figures which for the first time in 8 years, saw the price of everyday goods go down.

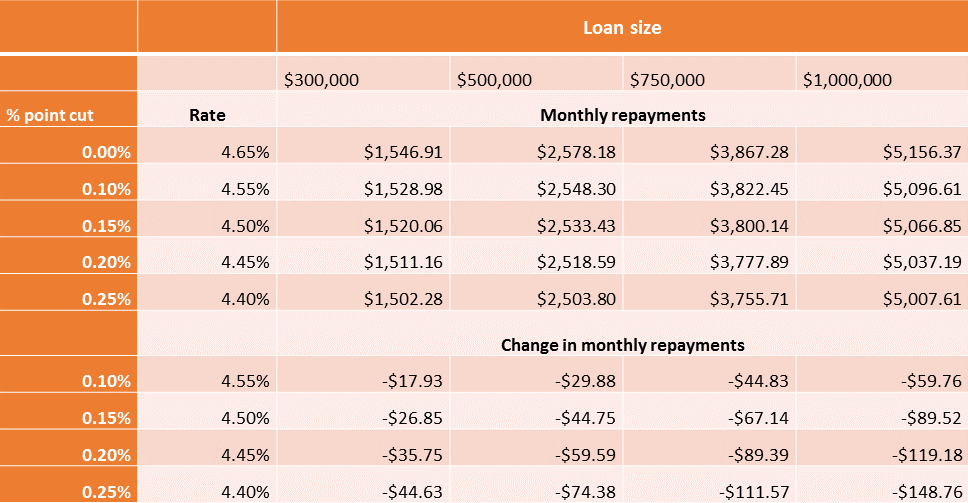

It's now up to each lender to pass this cut on – either in part or in full. Find out what this could mean to your variable home loan repayments using our chart below.

Impacts of a rate cut – national overview

Impacts of a rate cut – state by state breakdown

Notes:

- Calculations are based on a 30 year loan, starting at the current average variable rate of 4.65%, rounded to the nearest cent.

- Average loan sizes are based on ABS figures for Feb 2016

A list of lenders who have moved is here.

Compare all variable rates here.

Disclaimer

This article is over two years old, last updated on May 2, 2016. While RateCity makes best efforts to update every important article regularly, the information in this piece may not be as relevant as it once was. Alternatively, please consider checking recent infographic articles.

Fact Checked

Share this page

Get updates on the latest financial news and products

By continuing, you agree to the RateCity Privacy Policy, Terms of Use and Disclaimer.